The Craze for Government jobs in India has nothing to mention about. Here in this article, we will get to know about the Income Tax Officer Salary, Allowances Payscale etc. Well, this is one of the most famous posts in India and every year lakhs of students appear for the exam called SSC-CGL to get the post of Income Tax officer. First of all, let’s see the process of becoming an Income Tax Officer and later we will get to know their responsibility, Payscale, Allowances and what are the perks of being an Income Tax officer etc.

Table of Content

How to Become Income Tax Officer?

Income Tax Inspector, the group-c interview post chosen candidates by the central board of direct taxes, involves grouping direct taxes in India. Taxation involves Income Tax, company tax, capital tax, etc. An Income Tax officer could be a nice position by SSC CGL and offers a sensible social rank with a decent regular payment package.

Staff Selection Commissions (SSC) involve many vacancies below the CGL Exam The Exam is conducted once a year for a putative position in several departments like SSC CGL Income Tax Inspector, applied mathematics capitalist, Central Excise Inspector, Sub Inspector in CBI, applied mathematics Inspector, etc. The SSC Exam is conducted in 3 phases given below.

- Prelims

- Mains

- Descriptive Test etc.

Income Tax Officer Responsibilities:

The government of India has obligatory a tax on financial gain victimisation of the Income Tax act. consistent with this act, the person +under the tax section or section should calculate their total financial gain. once scheming the overall financial gain, one needs to submit their financial gain thoroughly to a specific department.

An IT officer is that one who scrutinizes all the main points of the financial gain of personnel. To become an associate ITO officer in India, interested candidates have to be compelled to clear a division communicating or get the direct achievement once finishing their government officials communicating, UPSC-IAS. The roles and associated responsibilities of an Income Tax officer are as follows.

- An ITO determines tax liabilities, investigates work to evasion, and individual & business audits.

- The department-appointed associate Income Tax officer primarily deals with the Central Board of Direct Taxes, which holds responsibility for tax-related matters, conjointly known as ‘tax specialist.’

- The Income Tax Officer examines and analyzes business and private accounts to grasp that the proper quantity of tax is being paid to India’s government.

- The Income Tax officer possesses glorious analytical skills and a high skill level, necessary to research tax fraud.

- The Income Tax department conjointly enforces laws just like the Benami Transactions (prohibition), 1988, and also the black cash act.

The general operating hours of presidency staff are 9 am to 5 pm. The mounted and outlined department timings for Income Tax officers vary for the department. however in sure cases, like raids or searches, associate Income Tax officers might have to be compelled to work for extended durations than usual.

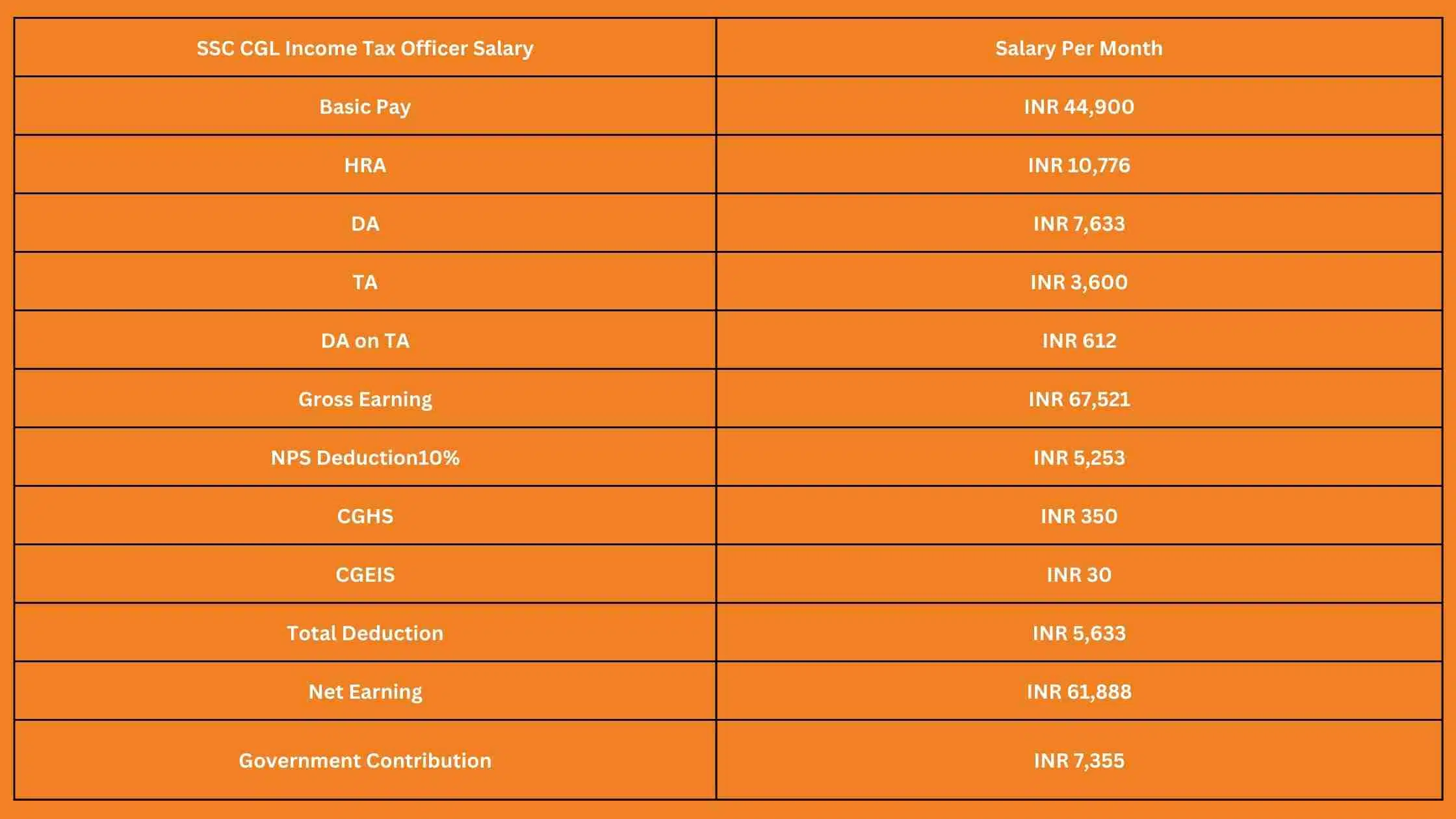

Income Tax Officer Salary Details:

The Income Tax Officer’s Salary in the service depends on a number of factors the City of posting, position and overall grade in the Service etc and more.

| SSC CGL Income Tax Officer Salary | Salary Per Month |

| Basic Pay | INR 44,900 |

| HRA | INR 10,776 |

| DA | INR 7,633 |

| TA | INR 3,600 |

| DA on TA | INR 612 |

| Gross Earning | INR 67,521 |

| NPS Deduction10% | INR 5,253 |

| CGHS | INR 350 |

| CGEIS | INR 30 |

| Total Deduction | INR 5,633 |

| Net Earning | INR 61,888 |

| Government Contribution | INR 7,355 |

Designation-Wise Salary in India

The Income Tax Officer’s Salary, Allowances and perks are keeps on changing with the experience and Promotion made in the Service. Here are the details about the salary as per the rank in the service.

| Rank | Pay Scale (Per Month) |

| Principal Chief Commissioner of IT | INR 80,000 |

| Chief Commissioner | INR 75,550 to 80,000 |

| Principal Commissioner | INR 67,000 to 79,000 |

| Commissioner | INR 37,400 to 67,000+Grade pay INR 10,000 |

| Joint Commissioner | INR 37400 to 67,000+Grade pay INR 8,700 |

| Deputy Commissioner | INR 15,600 to 39,100 |

| Assistant Commissioner | INR 15,600 to 39,100+Grade pay INR 5,400 |

| Income Tax Officer | INR 9,300 to 34,800+Grade pay INR 4,800/5,400 |

SSC, the employees choice Officer recruits for non-gazetted level jobs within the government victimisation the combined graduate level Exam. The ITO Exam is conducted and supervised by the employee’s choice workplace and a combined graduation Exam is once a year to pick out candidates for numerous positions like:

- Income Tax Inspector

- Central Excise Inspector

- Preventive Officer

- Sub Inspector in CBI

- Statistical Investigator, etc.

Income Tax Inspector is taken into account the foremost prestigious and fashionable job offered through SSC CGL. Timely promotion and job satisfaction with sensible allowances create it a good position to carry.

SSC Income Tax Officer Allowances

Apart from the Income Tax Officer Salary, there are also tons of allowances as well that one gets in the service. Here are the details about the Income Tax officer allowances:

- Dearness Allowance

- House Rent Allowance

- Travel Allowance

- Pension

- Paid Leaves

- Medical Benefits

- Increments etc.

The structure of the allowance is as follows:

| HRA (depending on the city) | X Cities (24%) | 10,776 |

| Y Cities (16%) | 7,184 | |

| Z Cities (8%) | 3,592 | |

| DA (Current- 17%) | 7,633 | |

| Travel Allowance | Cities- 3600, Other Places- 1800 | |

| Gross Salary Range (Approx) | X Cities | 66,909 |

| Y Cities | 63,317 | |

| Z Cities | 57,925 | |

Career Growth and Promotion:

Once the candidate is placed within the Income Tax Department, they will expertise a good life with extremely putative standing and time-to-time promotion and growth. The Income Tax department involves each table and munition, counting on the posting space and work assigned.

The post involves 2 sections as follows.

- Assessment Section: It primarily involves all table jobs and alternative work given by the Income Tax inspector.

- Non-Assessment Section: below this munition, the officer is going to be a neighbourhood of the fast response team and frequently conduct defaulters. In this, a table job is proscribed as they have to gather correct proof against defaulters.

Below are the necessary criteria for the Income Tax officer’s regular payment edges.

- The ordinance for associate Income Tax officers is thirty years, whereas there’s a relaxation within the higher age for OBC and ST/SC.

- With some years of expertise as an associate Income Tax inspector, a candidate is going to be transferred to the Income Tax officer department.

- The candidate is going to be promoted to Gazetted officer underpaying bureau four,600. And with ten to twelve years of expertise, they’ll be promoted to Assistant Commissioner of Income Tax.

- The candidate can get a promotion each 4-5 years. If a candidate joins the department at associate early age, they’ll get an opportunity to travel up to the extra Commissioner level.

These are the details about the Income Tax Officer’s Salary, Allowances and overall Payscale. Hope you got the complete details about this.